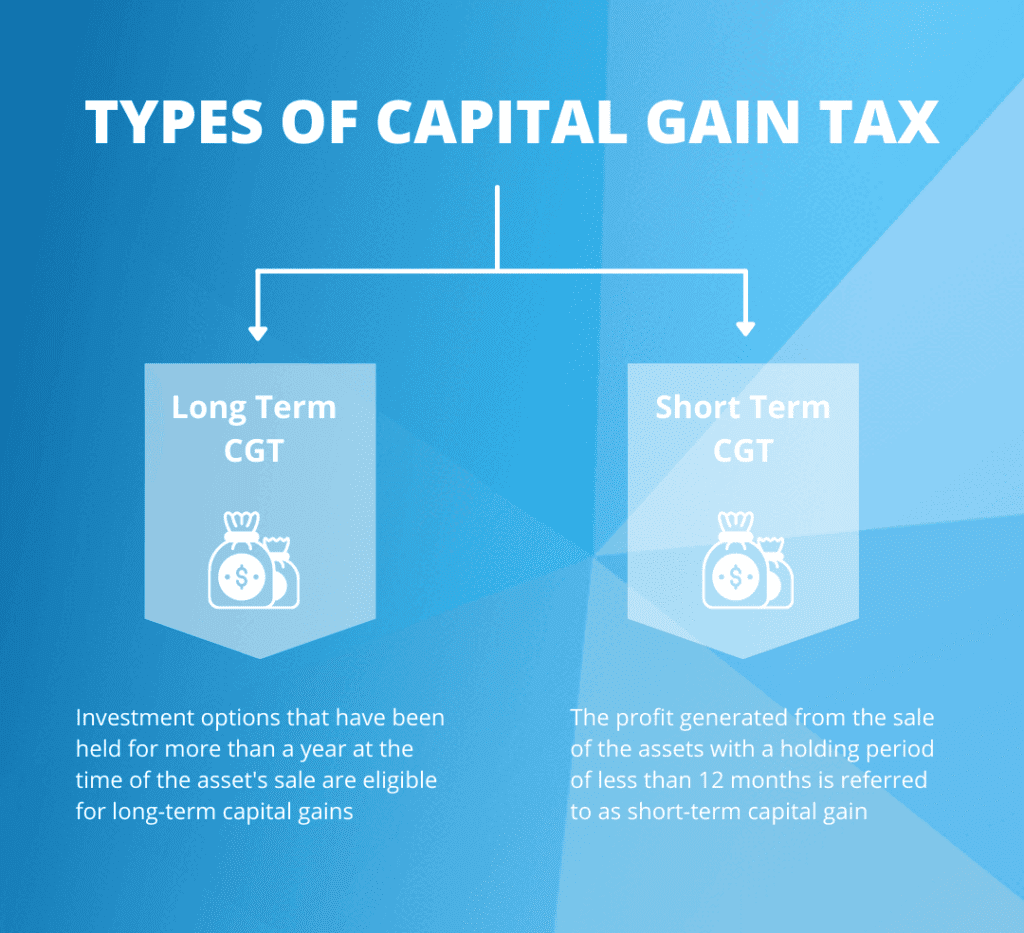

Capital gains tax (CGT) is a tax that is paid on the profit made from selling or disposing of certain assets, such as shares or property. In the UK, CGT can be a complex and confusing area of tax law, which is why it’s important to have an experienced team of tax professionals who can help you navigate the process and ensure that you’re paying the right amount of tax.

At Path Tax Accountants, we offer a comprehensive range of UK Capital Gains Tax (CGT) services designed to help individuals and businesses manage their CGT obligations. Our team of Chartered Accountants have years of experience working with clients across a wide range of industries, and we stay up-to-date with the latest changes in CGT law to ensure that we’re always providing our clients with the most accurate and effective tax advice.

Our UK Capital Gains Tax (CGT) services include:

1. CGT planning and advice: We can help you develop a comprehensive CGT strategy that takes into account your unique financial circumstances and objectives.

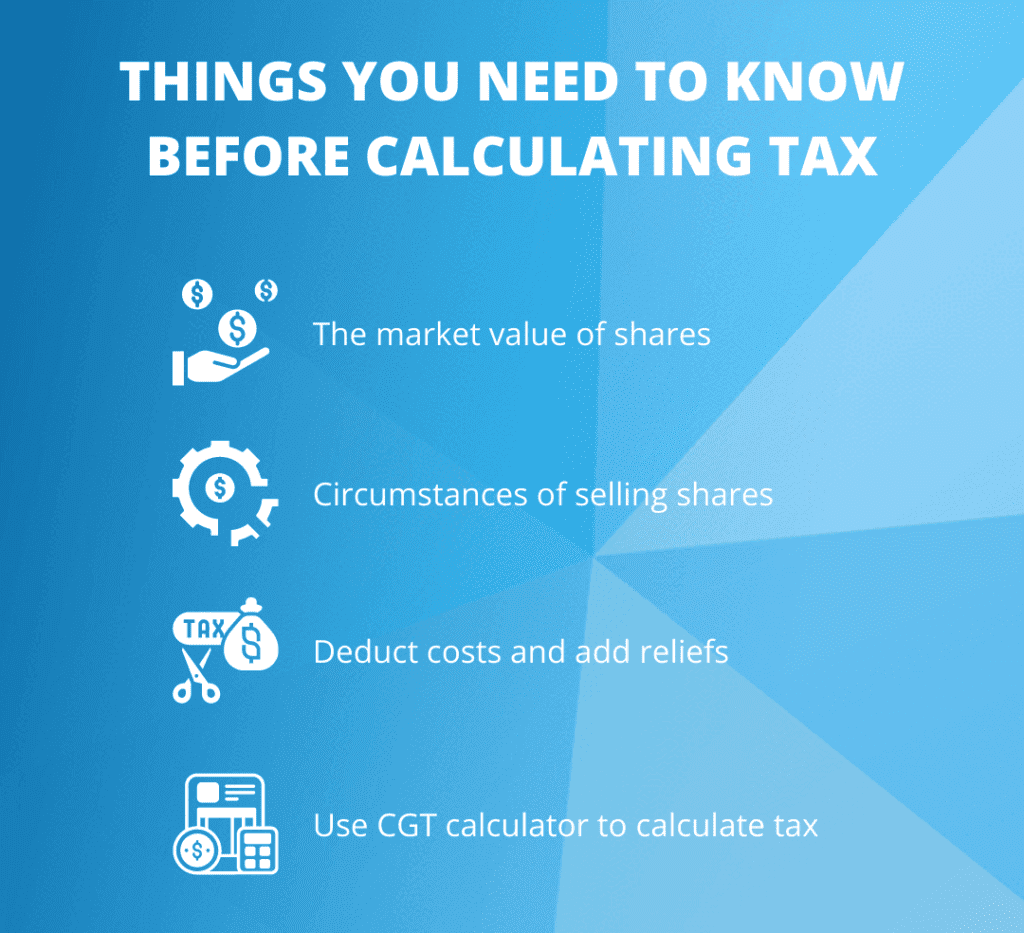

2. CGT calculations: We can calculate the CGT due on the disposal of your assets, ensuring that you’re paying the right amount of tax.

3. CGT compliance: We can help you stay in compliance with all applicable CGT laws and regulations, minimizing your risk of penalties and fines.

4. CGT consulting: Our team can provide ongoing CGT consulting and advisory services to help you make informed decisions about your financial strategy.

There are many common assets that may be subject to capital gains tax when they are disposed of, including:

- Stocks and bonds

- Residential properties

- Cryptocurrencies

- Paintings and many more

The capital gains tax legislation is very complex area. There are many reliefs and exemptions which could lead to significant tax savings. We can prepare your CGT computations and claim all allowable reliefs that you are entitled to. If you are planning on selling a property or asset, we can review your situation and provide tax planning advise to reduce potential tax liabilities.

At Path Tax Accountants, we understand that every client is different, and we work closely with our clients to tailor our UK Capital Gains Tax (CGT) services to their unique needs. Whether you’re an individual or a business owner, we’re here to help you manage your CGT obligations and maximize your financial success.

To learn more about our UK Capital Gains Tax (CGT) services and how we can help your business, contact us today.